- New Oxford Economics analysis identifies annual uptick of £4.1 bn for UK economy if SMBs’ adoption of digital skills and technology during lockdown is maintained

- Since COVID-19, one in five UK SMBs have begun e-commerce for the first time; previously only 7% of SMB turnover was from e-commerce

- Over half (58%) have adopted new digital tools while a quarter agree learning new digital skills is a positive development of lockdown

- 57% have made significant changes to their business as new SMB ‘cohorts’ emerge from digital acceleration: Hybrid High Street, Recession-Proofing and Live Links SMBs

London (UK): The rapid adoption of new digital skills and technology by small and medium-sized businesses (SMBs) during lockdown could lead to an additional £4.1 billion in UK GDP1 each year over the long-term2, according to new analysis developed by financial management software provider Intuit QuickBooks and Oxford Economics.

The findings come three months after The Digital Opportunity for Small Businesses report, which was published by QuickBooks and Oxford Economics pre-lockdown in March 2020. At that time the report identified a significant opportunity to boost UK productivity through digital upskilling and infrastructure.

Together the two reports provide an interesting analysis of the effect of three months of accelerated SMB digital upskilling as a result of COVID-19.

Despite the sizeable short-term effect of COVID-19 on the economy (69% of small businesses report a negative impact and 36% believe it will take between six and 12 months to fully recover3), Oxford Economics’ analysis suggests that if this unique period of accelerated digital upskilling continues, the associated productivity gains will persist.

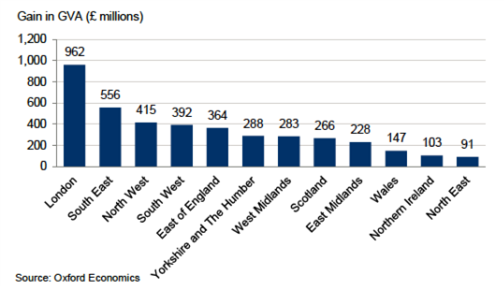

The report breaks down the gains by region, with London estimated to benefit the most (£962 million annually) (see fig 1).

Fig 1: The annual boost gross value added from the digital skills learned by SMBs and their greater adoption of digital technology under lockdown by region.

SMBs learn new skills and adopt technology during lockdown.

In March 2020, only 7% of SMBs’ turnover came from e-commerce4. Since lockdown, 20% of SMBs have started using e-commerce for the first time5, selling either via their website or an online marketplace, demonstrating the opportunity for SMBs to pivot or adapt their business.

And while less than half (47%) of SMBs had a website pre-COVID-19, one in ten (10%) have now set this up for the first time.

Nearly one in six (58%) SMBs have adopted some form of new digital technology for the first time since lockdown began, with the most common of these being:

- Phone or video conferencing tools (28%)

- Collaborative communication tools (e.g. Slack or Teams – 14%)

- Cloud storage or file management services (12%)

A quarter (25%) of SMBs reference the fact that they and their staff have learnt new digital skills as a positive development from lockdown.

With SMBs making greater use of digital, the majority (86%) say they have changed the way their business operates since COVID-19 hit, including 57% who describe these changes as significant. Of those who made changes, 80% expect some or all of these to be permanent – suggesting the shift towards digital will become a long-term feature of the SMB landscape.

The research has identified three common profiles of SMB businesses that have used digital to ‘pivot’ and evolve their business during lockdown.

- Hybrid high street SMBs: businesses that have shifted successfully to having both an online and physical presence and have changed their business model moving forward

- Recession-proofing SMBs: businesses that have spent time developing and investing in digital skills during lockdown, improving resilience ahead of a potential future recession

- Live links SMBs: businesses that have used digital to bring an experience or service into our home during lockdown, ensuring they were able to maintain revenue and income

Chris Evans, Vice President and UK Country Manager at Intuit QuickBooks said:

“COVID-19 presents the most challenging small business environment I’ve ever seen. We speak to owners and founders every day who have felt significant pain, most often around cash flow and making ends meet. But we’ve also seen first-hand just how agile and entrepreneurial SMBs can be, adopting new digital systems or models such as e-commerce in order to pivot their business, sometimes in a matter of days.

“We have always strongly believed that connecting all aspects of a business through digital – from cash flow and payments to payroll – can boost productivity and unlock new revenue opportunities. No one could have anticipated this pandemic would accelerate digital adoption by years, but SMBs are already experiencing the benefits that digital can bring.

“Continued use of digital tools will not only enable SMBs to survive; in time, they will thrive. We’re committed to giving small businesses the support they need, working hand-in-hand to create a more efficient, productive, digitally-first SMB landscape.”

About The Author

QuickBooks is dedicated to helping SMBs through the challenges created by COVID-19 through its small business support web page which features practical tips and resources, including its interactive virtual Ask the Expert series. The series has featured business leaders from accounting firms, tech start-ups and other small businesses, as well as government representatives including the Minister for Small Business Paul Scully MP and Shadow Chancellor Anneliese Dodds MP. Through its Ask the Expert series in the UK alone, QuickBooks has created over 580 pieces of content containing valuable advice and support, viewed by more than 60,000 small businesses.

To find out more about QuickBooks visit their website: https://quickbooks.intuit.com/uk/