Since the start of Corona, hundreds of thousands of people have been hit financially.

Millennials – those currently aged between 22 and 38 – tend to have it pretty tough already, but since the pandemic have reportedly been the worst affected age group.

If Covid has taught us anything, it is that we all need a financial safety net, and one much larger than we originally thought, if we are to be prepared for anything that might happen.

This lesson is especially important for younger age groups who seem to be the hardest hit when the worst happens.

The first financial priority should always be about survival – i.e. being debt free with enough cash set aside for emergencies, so you’re able to weather any storm that comes your way.

It will set you up to later be able to make better decisions for your future saving and investment planning, coming from a place of security.

‘Financial wellbeing’ is extremely important and massively impacts our general wellbeing – from our mental health to relationships with friends and loved ones – and it should be thought of in much the same way, too.

Just as mental wellbeing is about building resilience – starting with cutting out the bad and doing more of the ‘good’ i.e. eating healthily, sleeping well and getting physical exercise etc. – so too is financial wellbeing about building financial resilience.

It may sound cliche to have a ‘rainy day fund’ but unfortunately many people don’t have one, and are often caught short.

The truth is, the bumps in the road are the road: unexpected things always happen and you can only plan so much.

The best way to think about approaching your finances is like playing a video game.

There are different levels, and you should aim to complete each level before moving to the next.

Too often people are focussed on bigger goals – saving for a holiday, a house or retirement – when they haven’t set themselves up with the basics, and that is to be financially resilient in the face of the unexpected, by having an emergency cash fund saved up.

LEVEL 1: You have lots of debt and no emergency cash fund

The first thing to do, before setting up an emergency cash fund, is to make sure you’re clear of any debt.

Priority number one is clearing any credit cards and store cards as these are the worst culprits, this should be what all efforts are focussed on.

There is little point saving for anything else when debts are mounting and you’re paying eye watering interest that could be better spent elsewhere.

If you are still earning and able to pay more than the bare minimum monthly payments, make sure you know what interest you are paying and then see if you can lower this by taking out a loan / using an overdraft / finding another way to pay it off that charges you less interest.

Lots of people may feel scared to take out a loan when they’re already in debt, but often the loan can have better rates which allows you to put the money saved towards paying off your balance, resulting in a quicker end in sight.

For example, a £1000 credit card debt at 22% interest paid off and replaced with a loan charging just 7% is a saving of £150 a year, meaning you’re able to put that cash towards paying it off quicker.

There may be other ways to do it, but the key is understanding what you’re currently paying and finding a cheaper way to manage that debt.

If you’re in a more extreme situation with no income and debts mounting, you’ll need to take more drastic action in order to try and stop the situation spiralling out of control.

It can be easy to bury your head in the sand and ignore letters and calls from the companies chasing debt, however, if you haven’t done so already, explaining to them that you’re in financial difficulty and letting them know about your situation can help.

There are many codes of practice that the everyday person on the street doesn’t know about, and these generally agree that creditors should stop or reduce charges and interest on a debt when someone is in financial difficulty.

They won’t do this without being asked of course, so speaking up is critical.

Since Corona this has become more prominent: The Financial Conduct Authority (FCA) has asked banks to make current account overdrafts interest-free up to £500, so check that this is in place with your bank.

Also, ‘payment holidays’ have been introduced for credit cards, many loans, store cards, and finance options for cars etc. which can reduce the pressure and late charges whilst you sort your personal working situation out, or explore your options.

Most companies will give you breathing space of 30 days if you explain you’re in trouble and seeking advice.

This breathing space can take the stress off and allow you to reach out to one of the many organisations that are set up to help you.

Just like mental health, the trick is asking for help.

The Money Advice Service is a free service run by the government packed full of resources, but many people don’t know about it.

It also signposts to specific charities and organisations that can give debt advice, such as StepChange, for example, which offers very useful resources online and can help you to create a budget and undertake full debt advice, completely free of charge.

As part of any debt advice you take, they can also help you to build a case to persuade your debt collectors to reduce or stop interest.

Although not guaranteed, if this is successful it will give you more time to repay the debt without the figure increasing past a point of no return.

They also have an online benefits checker that will alert you to money you’re entitled to that you may not be aware of, which can contribute to paying off your debt.

LEVEL 2: No debt and no emergency cash fund

The goal for this level is to avoid going back into debt, and to start building an emergency pot of money you can rely on when the unexpected happens.

Everyone’s emergency cash fund will be different, but based on the amount of time Corona has impacted us, three to six months worth of your critical outgoings would be the most sensible.

This pot of money is set aside and used when the unexpected happens to avoid you dropping down a level into, or back into, debt.

Think about your money like you do your smartphone battery.

We know exactly what to do when we hit that low 20% battery moment – we shut down the energy draining apps and go into power saving mode.

Some of us might have a spare battery pack we can use to charge it up again.

This is your emergency fund and the ultimate goal here – to have cash set aside to make sure you’re never completely out of juice.

Without an emergency fund, you’ll need to put yourself into ‘money saving mode’ each time until you can save enough to create this buffer.

Start with a ruthless analysis of what you’re spending: go through your bank statement and direct debits and make a list of ‘necessities’ and ‘non-essentials’ and really ask yourself if you truly need everything, such as subscriptions and memberships.

Even rent, which feels like an essential, could be put towards creating that financial float if you’re able to move in with your parents for a few months, especially when remote working is more widely accepted now.

There’s a famous quote that says ‘you can have anything you want, but you can’t have everything you want’ and it’s true, but these smaller sacrifices aren’t forever and will add up to help you build that buffer.

When you get an unexpected bill, or a financial emergency arises, you can dip into your pot without the stress that comes with not knowing how you’ll cover it, and without impacting your day to day lifestyle.

You’ll need to always top up the pot again by going into money saving mode until you’ve repaid what you used, before moving onto or continuing with the next level.

One thing Corona has shown up for many people is where they can make cut backs in their life – for example eating out less, or home workouts vs gym memberships.

It is definitely worth considering what lifestyle changes you’ve been forced to make during lockdown that you can continue when the world goes back to normal, to help build that buffer as quickly as possible and move onto the next level of your personal finances.

LEVEL 3: No debt and an emergency cash fund

You’ve built up your financial resilience – you’re no longer in any debt and you have a pot set aside to cover any unexpected emergencies so that you don’t fall back into money troubles.

Now you can think about what your longer term goals are and how you will achieve them.

All investment decisions should start with the following two questions:

• What are the things you want to do?

• When do you want to do them?

The answers to these will determine how much risk you want to take on and the time period for your investments.

For example, if you want to buy a house in the next three to five years you’ll want to save in a way that isn’t as risky as if you were saving for your retirement, and in a way that is flexible so you can withdraw your money when you need.

That rules out investment vehicles like a pension and the stock market, as pensions lock your money away until a certain age and the fluctuating stock market requires an extended time period of usually more than five years, in order to weather the ups and downs and see your return.

You’ll want to consider ISAs, and the LISA – providing you understand the penalties that come with withdrawing outside of the terms you’ll sign up to.

Again, this is why building an emergency pot is a crucial level before investing for longer term goals, as you shouldn’t need to dip into a LISA if you’ve saved for emergencies.

If you’ve got a home already, or you’re able to save for both a shorter term goal like a house purchase as well as for your retirement, you can consider riskier, less flexible and longer investments also, with the understanding that in the short term your money could go up or down.

Taking the steps to progress up through the levels will give you the confidence to be comfortable with this, as the money invested isn’t needed in the near future to pay off debts, bail you out of emergencies, or even go towards your shorter term life goals.

Being confident and comfortable are two objectives you should set yourself during this level, with the final piece of advice to become more comfortable talking about money with others.

We don’t talk enough about money as it’s considered taboo, but there’s a lot of knowledge out there which could help you with your planning and decision making.

This could be from a professional, or some of your friends and family, so ask around and get regular help from people who know more about money than you, and who are on your side.

Final words:

Personal finance is all about levelling up, and focussing on the basics before moving to the next stage.

The unexpected will always happen, and if you do fall into a different level again, be sure to focus on winning that level before moving onto the next. This really is the key for financial resilience and better financial wellbeing.

By Rob Gardner

ABOUT ROB GARDNER

ABOUT ROB GARDNER

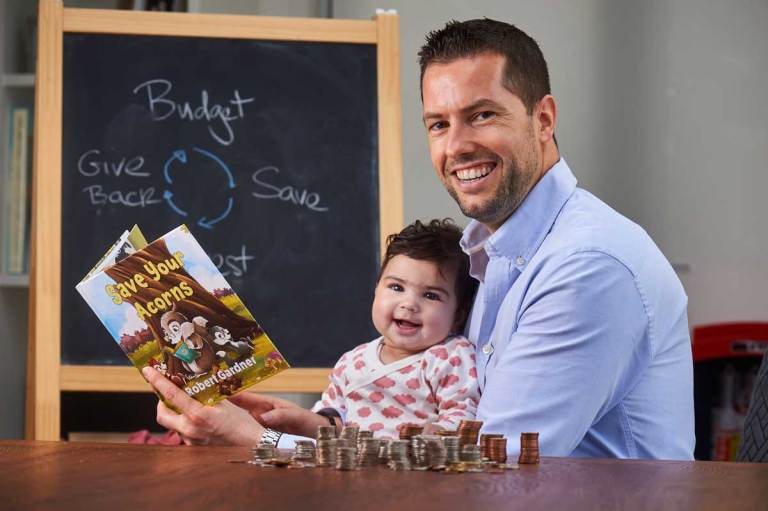

Rob Gardner is a financial education campaigner and a father of two young daughters. He believes financial education is the building block for financial wellbeing and that every child should know how money works and how to make it work for them.

Aside from his day jobs as founder of Redington, mallowstreet and the Investment Director on the executive board for St. James’s Place Wealth Management, Gardner co-founded RedSTART in 2012, a financial education charity which aims to plant the seed for the financial wellbeing of young people and give them great money habits, delivered in a fun, gamified way.

In 2017 he gave a TEDx talk on the importance of teaching children about money, he is a member of the World Economic Forum Retirement Council and chairs the Children’s Financial Education Policy Council in the UK.